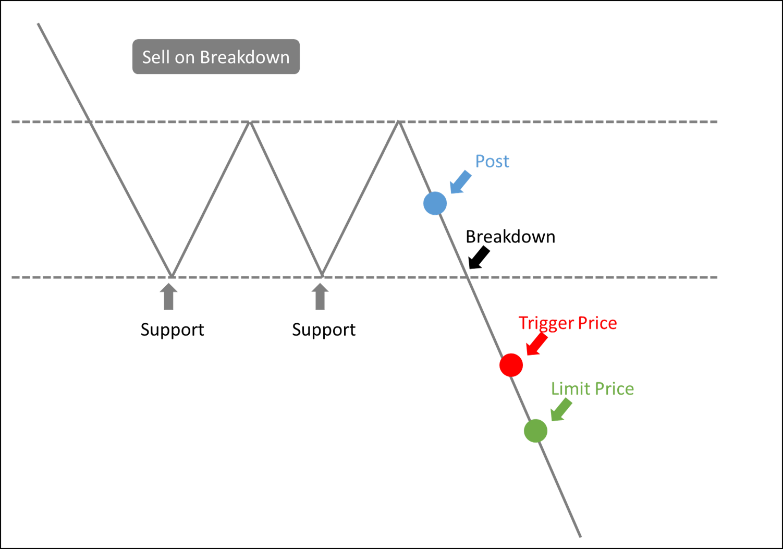

Mitigate Losses: Sell on Breakdown

This ensures that possible losses are kept at a minimum by setting the limit to the losses you’re willing to take.

To post a sell Stop Limit, set the trigger price below the current price.

*Note: If you make the mistake of setting it at or above the current price, your order will be posted immediately and be treated like a regular sell order.

Example:

Let's say you just bought ABC stock at Php 100 because you believe the price is close to a major support level and will likely go up from here. You want to mitigate your losses just in case you are wrong by selling the stock when it hits Php 90 within one month. You want to receive no less than Php 80 for the sale.

You may enter a sell stop limit with the following details:

| Enter Order: | Sell |

| Trigger Price: | Php 90 |

| Limit Price: | Php 80 |

| Expiry: | GTM |

Remember that once the stock hits your trigger price within you specified expiry period and posted, the order must be filled within the day. The order will expire the next day if not fulfilled.

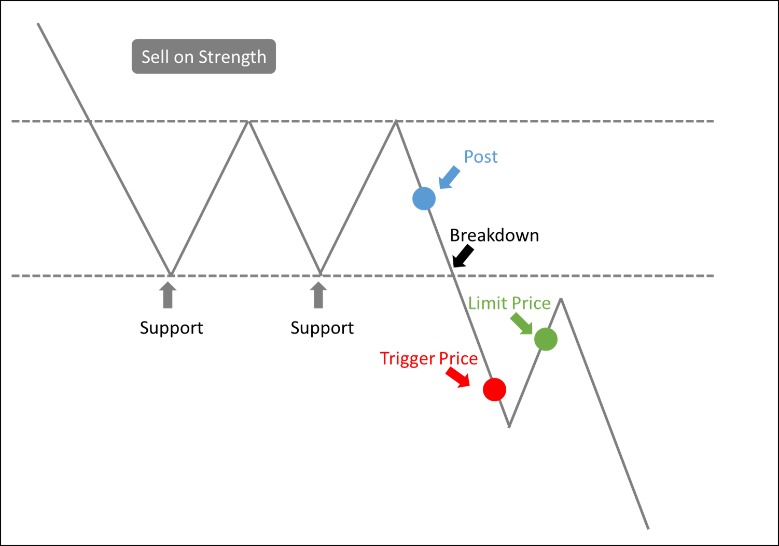

Protect gains: Sell on Strength

This strategy ensures that gains are locked before the price of the stock goes down.

To post a sell Stop Limit, set the limit price above the trigger price.

*Note: If you make the mistake of setting the limit price at or above the current price, your order will be posted immediately and be treated like a regular sell order.

Example:

Assume that you own shares of ABC stock which is currently trading at Php 100. To protect your gains, you want to be able to automatically sell the stock when it touches Php 90 within the week. But you are not willing to sell for less than Php 92.

You may enter a sell stop limit with the following details:

| Enter Order: | Sell |

| Trigger Price: | Php 90 |

| Limit Price: | Php 92 |

| Expiry: | GTW |

Remember that once the stock hits your trigger price within you specified expiry period and posted, the order must be filled within the day.The order will expire the next day if not fulfilled.