While both are 2-step conditional orders, they are used for entirely different purposes. Using the right order type can make a huge difference in managing your potential gains and losses.

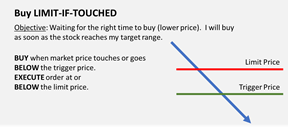

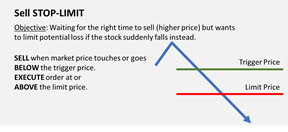

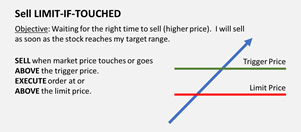

Below is a quick guide on when to use a Stop-Limit Order and a Limit-if-Touched Order:

|

Stop-Limit Order (Minimize Risk) |

Limit-if-Touched Order (Seize Opportunity) |

|

|

|

|

While the position of the Trigger Price is crucial in entering the right conditional order type, the limit price can be placed anywhere relative to the current market price and trigger price.

Remember that the limit price is the highest price you are willing to pay for a stock in the case of a buy order, or the lowest price you are willing to accept in the case of a sell order. If the limit price is set too high (in a sell order) or too low (in a buy order), the order may not be filled which will do you no good.