TRADING WITH CONDITIONAL ORDERS

Limit your risks by setting up your entry and exit points ahead of time using conditional orders.

Conditional orders allow you to preset the conditions that will trigger the purchase or sale of stocks, so you can execute your plan precisely even when you are not watching the market.

With conditional orders, you can easily…

- Plan your trades

- Set conditions that must be satisfied first before your order is posted for matching

- Execute your exit strategy with less emotion and more discipline

- Buy stocks at favorable entry points without constant monitoring

Types of Conditional Orders available on FirstMetroSec:

|

1. Stop Limit - A limit order that is activated under one preset condition. The condition may be one of the following:

Stop-Limit is useful for protecting against huge losses or catching a rising stock. Available on PRO, NEW and GO mobile app |

|

2. Limit-if-Touched or LIT – Like Stop Limit, LIT is a limit order that is activated under one preset condition. The condition may be one of the following:

Limit-if-Touched is useful for taking profit on arising stock or catching a buying opportunity on a falling stock. Available on PRO, NEW and GO mobile app |

|

3. Order-Cancels-Other or OCO – A conditional order that gives you the option to place a Stop Limit order and a LIT order simultaneously for the same stock, but only one limit order, whichever gets triggered first, will be activated, while the other order will be canceled Available on PRO and GO mobile app |

|

4. Order-Triggers-Other or OTO – A conditional order that gives you the option to place two opposite limit orders for the same stock (“primary” and “secondary”) simultaneously, but the secondary order will only be activated if the primary order gets fully filled. Available on PRO and GO mobile app |

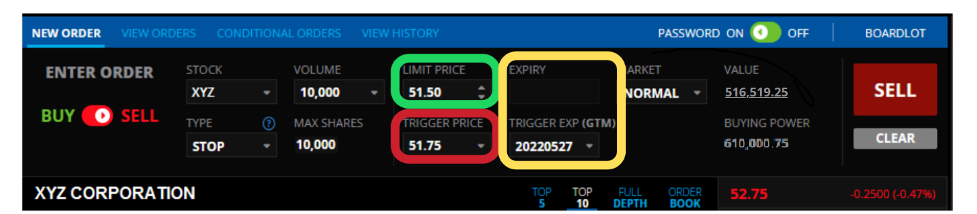

Placing a Conditional Order

A conditional order requires three important inputs:

- Trigger Price is the price that must be reached by the stock (“the condition”) before the order is posted.

- Limit Price is the price at which you want to fill your order, or better.

- Expiry is the length of time you are willing to wait for the stock to hit your Trigger Price (DAY, GTW, or GTM).

Input all the required information. Click Buy/Sell, then confirm the order by entering your password.

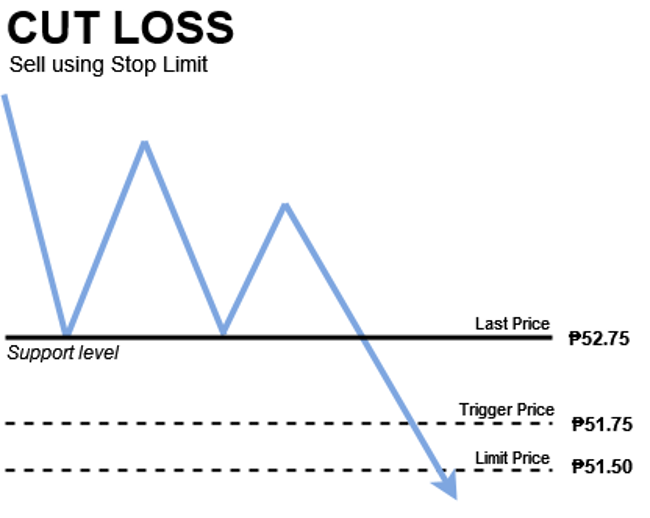

Cutting Loss

Planning your cut loss strategy ahead of time can help you avoid excessive (or minimize) losses and exit your position before it is too late. Set your protective stop using the following conditional orders:

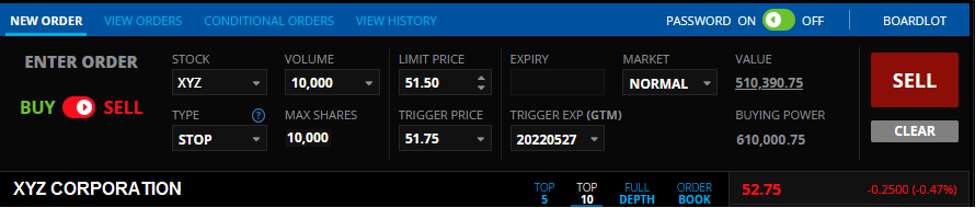

A. Stop Limit

Limit your loss in case the price plummets or goes below the support by selling using Stop Limit.

Suppose that you have 10,000 shares of Stock XYZ. You want to cut loss as soon as the price goes below the support. You can instruct the system to post a sell order if the price goes down to P51.75 (your Trigger Price). To increase the chance of all of your shares being sold, consider making your Limit Price lower than your Trigger Price.

Price Guide:

Last Price > Trigger Price > Limit Price

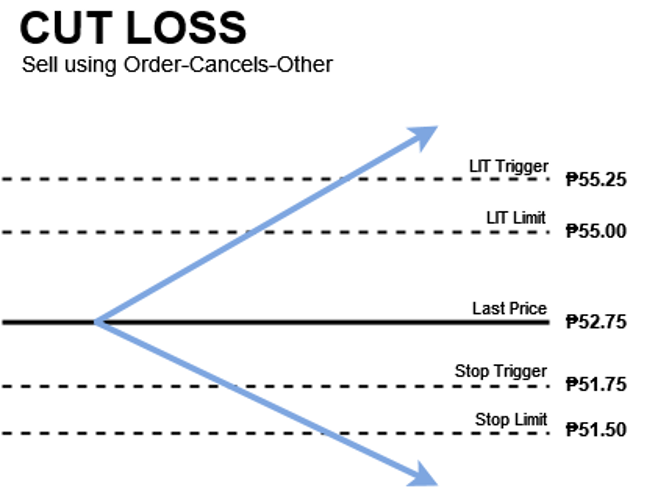

B. Order-Cancels-Other

You may use OCO if you want to sell your shares in case of a breakdown, but still want to sell at your target price in case the price rallies instead. OCO can protect your trades against whipsaw movements or sudden switches in price direction.

Using the previous example, you can instruct the system to post a sell order if the price:

- Drops to P51.75 (your Stop Limit Trigger Price), to be filled at P51.50 (your Stop-Limit Limit Price), OR

- Breaks out/increases to P55.25 (your LIT Trigger Price), to be filled at P55.00 (your LIT Limit Price)

Note that setting limit prices below trigger prices increases the chance of your order getting filled.

Price Guide:

LIT: Last Price < Limit Price < Trigger Price

Stop Limit: Limit Price < Trigger Price < Last Price

Buying the Dip

A dip is a temporary decline in price, allowing investors to buy or increase their shares at a bargain price. Before buying the dip, evaluate if the stock has a strong indication of recovery or an increase in value. You may use the following conditional orders to catch this buying opportunity:

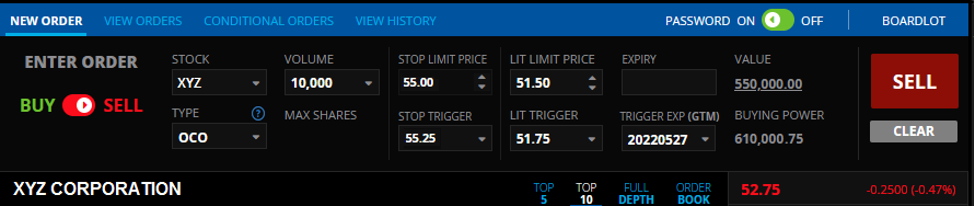

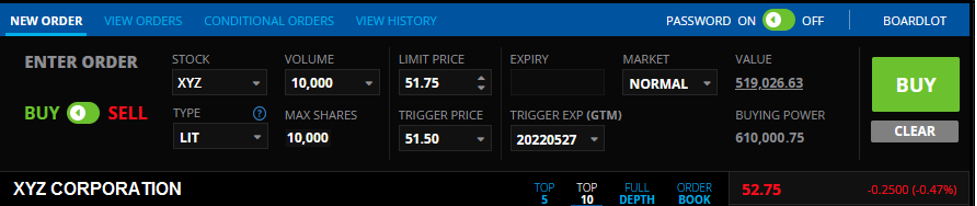

A. Limit-if-Touched

Post a buy order only after (or only if) the price goes down to your target range using LIT.

For example, you are waiting to buy Stock XYZ, which is trading at P52.75, once the price falls to what you think is a good price or its support. Before the price rallies again, you can instruct the system to post a buy order once the price goes down to P51.50 (your Trigger Price). To improve the chance that your order will be fully filled, you may buy up at P51.75 (your Limit Price).

Price Guide:

Last Price > Limit Price > Trigger Price

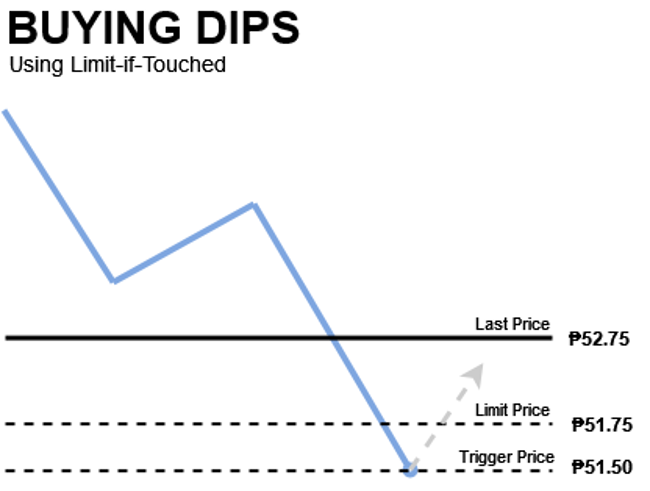

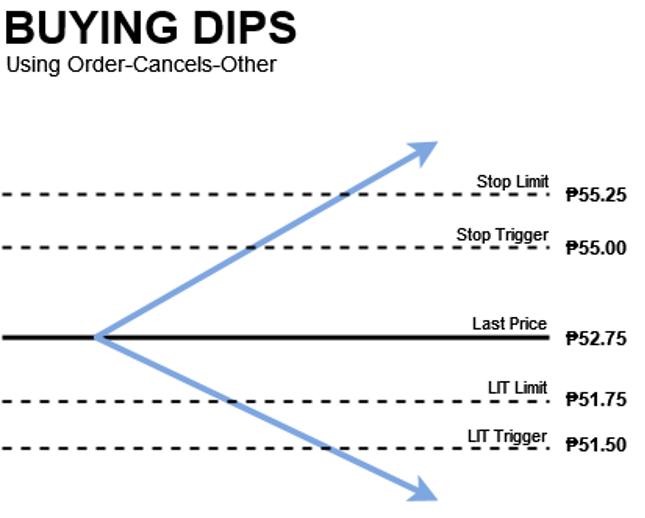

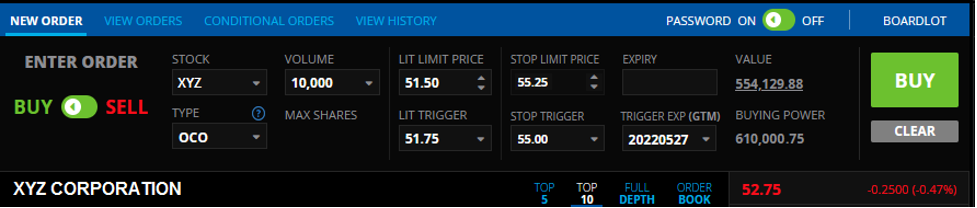

B. Order-Cancels-Other

You may use OCO if you want to buy once the price drops, but still not miss out if the price rallies instead. OCO can protect your trades against whipsaw movements or sudden switches in price direction.

Using the previous example, you can instruct the system to post a buy order if the price:

- Drops to P51.50 (your LIT Trigger Price), to be filled at P51.75 (your LIT Limit Price) OR

- Breaks out/increases to P55.00 (your Stop-Limit Trigger Price), to be filled at P55.25 (your Stop-Limit Limit Price)

Note that placing limit prices above trigger prices increases the chance of your order getting filled.

Price Guide:

LIT: Last Price > Limit Price >Trigger Price

Stop Limit: Last Price < Trigger Price < Limit Price

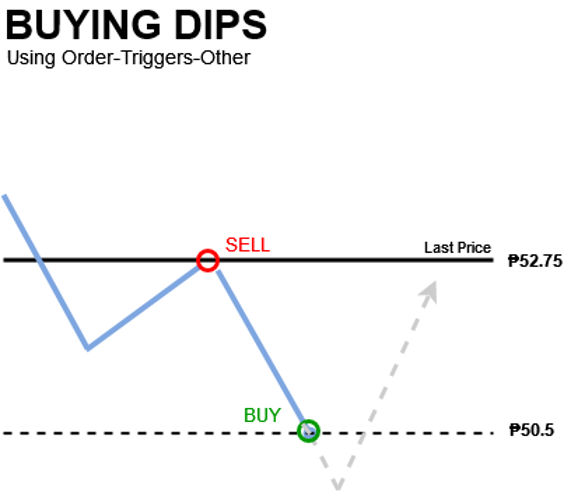

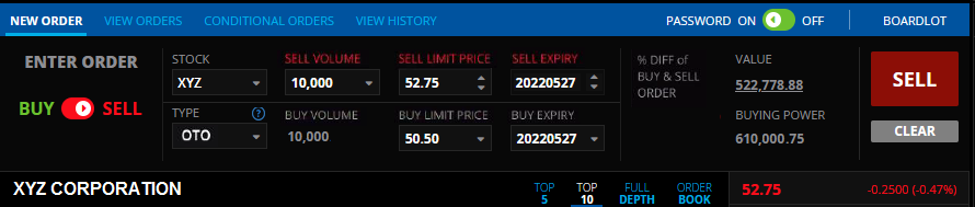

C. Order-Triggers-Other

What if you already have shares of Stock XYZ? You can still take advantage of dips by selling at the last price, then buying back shares once as the price goes down using OTO. This can be used by investors who want to average down.

Using the previous example, you may set the primary sell limit price at the last price (P52.75), and the secondary buy limit price at P50.5 (below your sell price). Your primary sell order must be fully filled first before your secondary buy order will be posted.

Price Guide:

Sell Limit: Any (above, equal, or below the last price)

Buy Limit: Must be lower than the Sell Limit Price

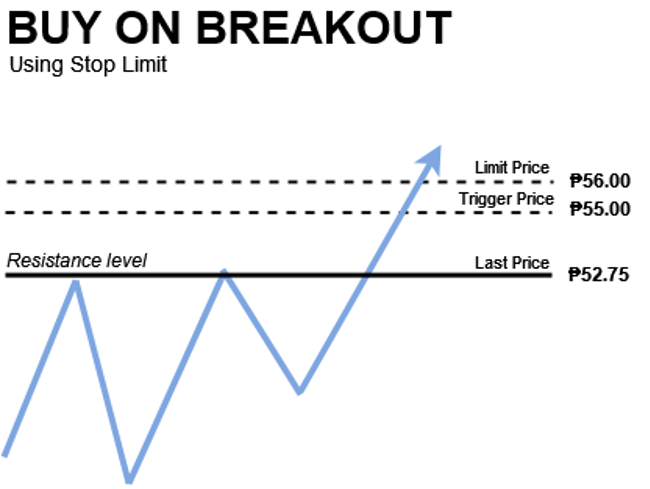

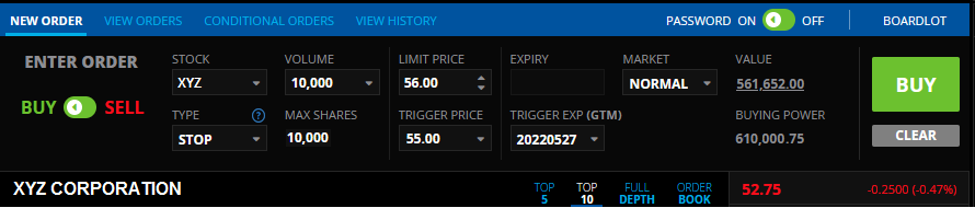

Buying on Breakout

A bullish breakout occurs when the price goes above the resistance, usually indicating a start of an uptrend, especially if supported by heavy volume. You may trade breakouts using Stop-Limit Order.

If you buy using an ordinary limit order, your order will be posted immediately, even if the price fails to break out. Post a buy order only after (or only if) the price breaks above the resistance using Stop-Limit.

Assume that you only want to buy Stock XYZ if it finally breaks above its P52.75 resistance. You can instruct the system to post a buy order once the price goes up to P55.00 (your Trigger Price). To ensure that your order will be fully filled, you may buy up at P56.00 (your Limit Price).

Price Guide:

Limit Price > Trigger Price > Last Price

View FAQs on Conditional Orders HERE.